The Exemption Claim Form Kit

An Attorney-Crafted Solution for Unfreezing Exempt Funds from Frozen Bank Accounts in New York

Under New York CPLR §§ 5205, specific funds are protected from bank freezes. Exempt funds include social security, pensions, disability benefits, and a portion of recent income — 90% of earnings from the last 60 days. A "freeze" refers to a legal hold or restraint placed on a bank account, preventing the account holder from accessing its funds. The creditor initiates the "freeze" by mere service of a restraining notice. The freeze aims to secure funds until a judgment is made regarding the debt. In New York, judgment creditors may freeze double the amount of the judgment.

Yet, the burden of proof lies with the account holder to claim these exemptions, which can be as daunting as the freeze itself. The process involves legal forms, strict deadlines, and a precise understanding of exemption laws—a triad that often compels individuals to seek expensive legal help.

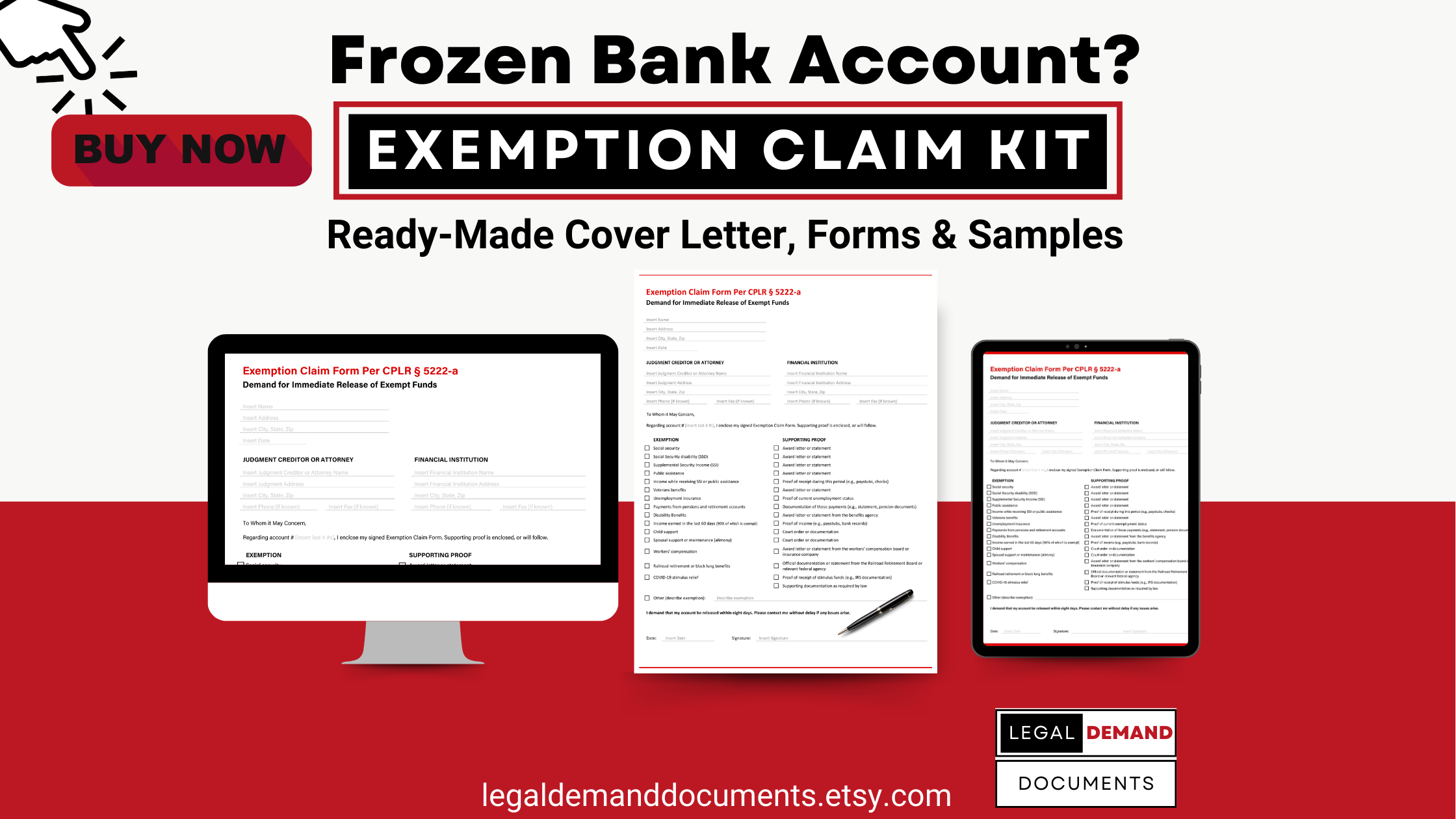

Introducing the Exemption Claim Form Kit: A Practical Guide Resolve Bank-Account Freezes

Enter the Exemption Claim Form Kit, a direct solution crafted by The Langel Firm’s founder, Jesse Langel, Esq., LL.M., and introduced to the public through an innovative Etsy Shop, "Legal Demand Documents." With nearly 15 years of defending consumers against such freezes, Jesse Langel has distilled his expertise into a comprehensive package that guides you through the exemption claim process.

The Exemption Claim Form Kit is an attorney-crafted solution that simplifies the reclaiming of control over frozen funds. It's an empowering alternative for New Yorkers who face the daunting task of unfreezing their bank accounts without incurring the hefty costs typically associated with legal representation. Presented in a digital format, the kit includes fillable forms, a professional cover letter, and detailed instructions laying a clear path through the frightening experience of bank account freezes.

As we delve deeper into this blog post, we'll explore the common hurdles faced by those with frozen accounts, the inner workings of the Exemption Claim Form Kit, and the plethora of reasons why this tool may be a financial essential for anyone caught in the cold grasp of a creditor's judgment in New York.

Section 1: Understanding Bank Account Freezes

The Cold Reality of Frozen Bank Accounts

When a New York state court issues a judgment against a debtor, one of the most immediate and disruptive enforcement actions a creditor can take is to freeze or hold the debtor's bank account. This legal mechanism, known as a bank account freeze or restraint, is a powerful tool in a creditor's arsenal, allowing them to latch onto the debtor's funds, effectively immobilizing them. It's a process that typically begins when the creditor serves a restraining notice upon a financial institution, which, in turn, must freeze the accounts up to twice the amount of the judgment.

Understanding CPLR §§ 5222 and 5222-a

Familiarizing oneself with the New York Civil Practice Law and Rules (CPLR) §§ 5222 and 5222-a is central to understanding and addressing a bank account freeze. These statutes delineate the framework within which creditors operate and provide a lifeline for debtors in the form of exemptions.

CPLR § 5222 outlines the procedural aspects of restraining notices and executions against property, while § 5222-a specifically deals with exempting certain personal property from application to satisfy money judgments. Under these sections, a range of funds are considered exempt, including social security benefits, public assistance, pensions, certain other public and private benefits, and 90% of income earned within the last 60 days. This means that creditors cannot legally restrain or seize these funds. However, the onus is on the account holder to assert these exemptions promptly.

In summary:

- CPLR § 5222: Broader framework for restraining various accounts and enforcing judgments.

- CPLR § 5222-a: Focused on bank accounts, with specific procedures and detailed exemption provisions.

The challenge for many New Yorkers is understanding these laws and actively navigating the process to claim their rightful exemptions. The procedure involves submitting detailed forms and adhering to strict deadlines, and it often requires a level of legal insight that many individuals lack.

The Exemption Claim Form Kit: Cutting To The Point

Crafted with precision by Jesse Langel, Esq., LL.M., it's a user-friendly toolkit that simplifies the complexity of CPLR §§ 5222 and 5222-a into a straightforward checkbox and fillable form system. Effortlessly assert your rights with minimal writing and maximum confidence.

With this kit, you’re equipped with intelligently designed, easy-to-use forms that cover a comprehensive list of exemptions, complete with a checkbox-style selection for quick identification. Accompanied by a professional cover letter template, these forms ensure clear communication with creditors and banks.

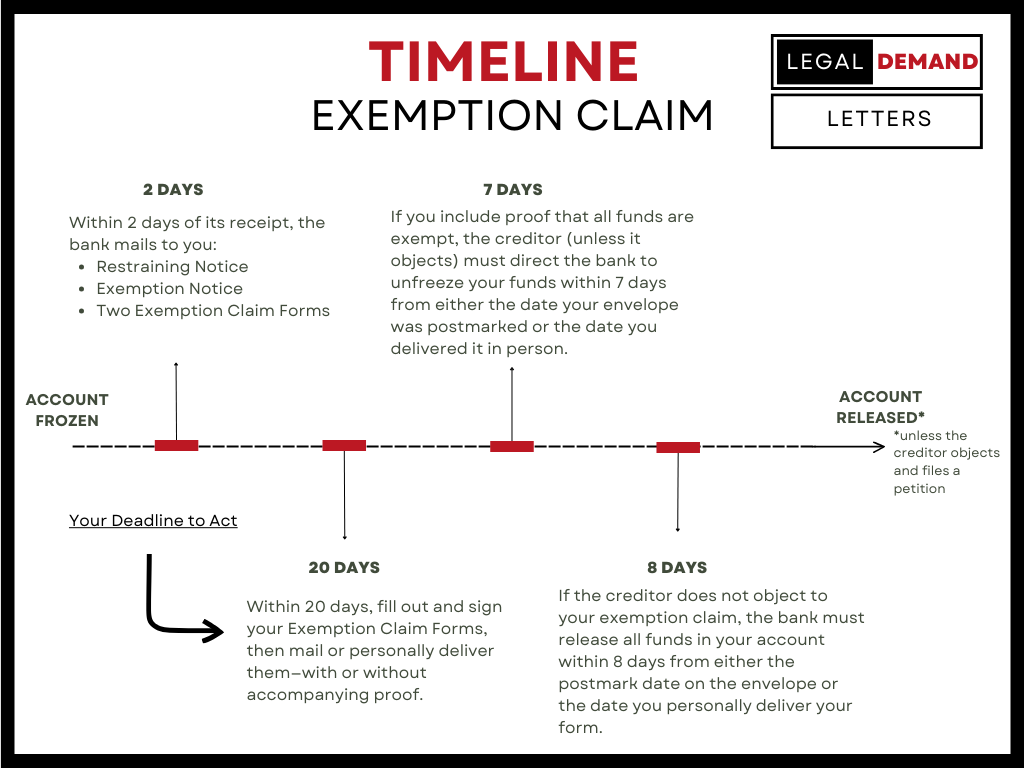

Below is a timeline graph contained in the Exemption Claim Kit.

Source: Exemption Claim Form Kit, LegalDemandLetters

Section 2: The Financial and Emotional Toll of Frozen Accounts

When Finances Freeze Over

Freezing a personal bank account is more than just a legal action—it's a personal crisis that casts a profound and immediate paralysis over one's financial well-being. For many New Yorkers, a bank account isn't just a repository of funds; it's a lifeline connecting them to their earnings, ability to pay for daily necessities, and financial future. The repercussions are immediate and severe when access to this lifeline is suddenly cut off.

Imagine the scenario: you go to pay for groceries, only to have your card declined. Rent is due, but your payment bounces back. Checks you've issued for utilities are returned, marked 'insufficient funds. This is the stark reality for individuals facing a bank account hold. The financial hardship is palpable, as the funds you rely on to sustain yourself and your family are locked up for double the judgment amount.

Devastating Consequences of Bank Restraints

The freeze doesn't just affect the account holder; it reverberates through the entire family unit. It can mean that a child's school fees go unpaid, medical appointments are canceled due to fear of incurring more costs, and the fundamental security that comes from being able to afford one's home and utilities is destabilized. For businesses, especially small enterprises, it can spell a sudden halt in operations, a domino effect that can lead to loss of income, layoffs, and, in some cases, closure.

The Emotional Iceberg

These bank holds take an emotional toll. The stress of being unable to access one’s money can be overwhelming. It leads to sleepless nights, anxiety, and a pervasive sense of uncertainty that can strain relationships and impact mental health. The stigma associated with financial struggles is another layer of distress, one that can prevent individuals from seeking the help they need.

The emotional impact is compounded by the complexity of the situation. For most people, the legal system is a maze of confusing terms and procedures. The fear of making a mistake that could exacerbate the situation is a significant source of stress. In the face of such overwhelming odds, despair can set in, making a difficult situation feel insurmountable.

For more information about how emotions affect financial behavior, click The Common Emotions Sabotaging Your Finances.

The Need for Accessible Solutions

This dire picture underscores the urgent need for an accessible solution. The law provides mechanisms for relief, but the path to accessing this relief must be clear and navigable. Tools and resources that can educate and empower individuals to take action on their behalf are not just helpful—they're necessary for the health and stability of our communities.

The Exemption Claim Form Kit was designed with this need in mind. Equipping individuals with the knowledge and tools to assert their rights and navigate the exemption process is a vital bridge back to financial stability. As we continue to explore the kit's components and benefits, we'll see how it not only provides a practical solution to a financial problem but also serves as an emotional balm, offering hope and a way forward during a crisis.

Section 3: Introducing the Exemption Claim Form Kit

An Innovative Approach to Resolving Bank Freezes

In the face of threatening bank account freezes in New York, the Exemption Claim Form Kit emerged to foster self-help and empowerment. This innovative solution is the brainchild of Jesse Langel, Esq., LL.M., a seasoned consumer protection attorney and founder of The Langel Firm. It's a product born out of nearly two decades of experience in consumer advocacy, a tool designed to arm New Yorkers with everything they need to confront and resolve the issue of frozen bank accounts quickly.

The Exemption Claim Form Kit embodies a simple yet powerful idea: individuals can navigate the legal system and reclaim control over their funds with the right resources. This kit directly answers the complexities and costs associated with bank account freezes, offering a straightforward path to resolution that was once only accessible through legal representation.

Below is our Etsy Shop:

The Contents of the Kit: A Closer Look

At its core, the Exemption Claim Form Kit is a comprehensive toolkit with a suite of documents carefully curated to guide users through the exemption claim process. Here’s what the kit contains:

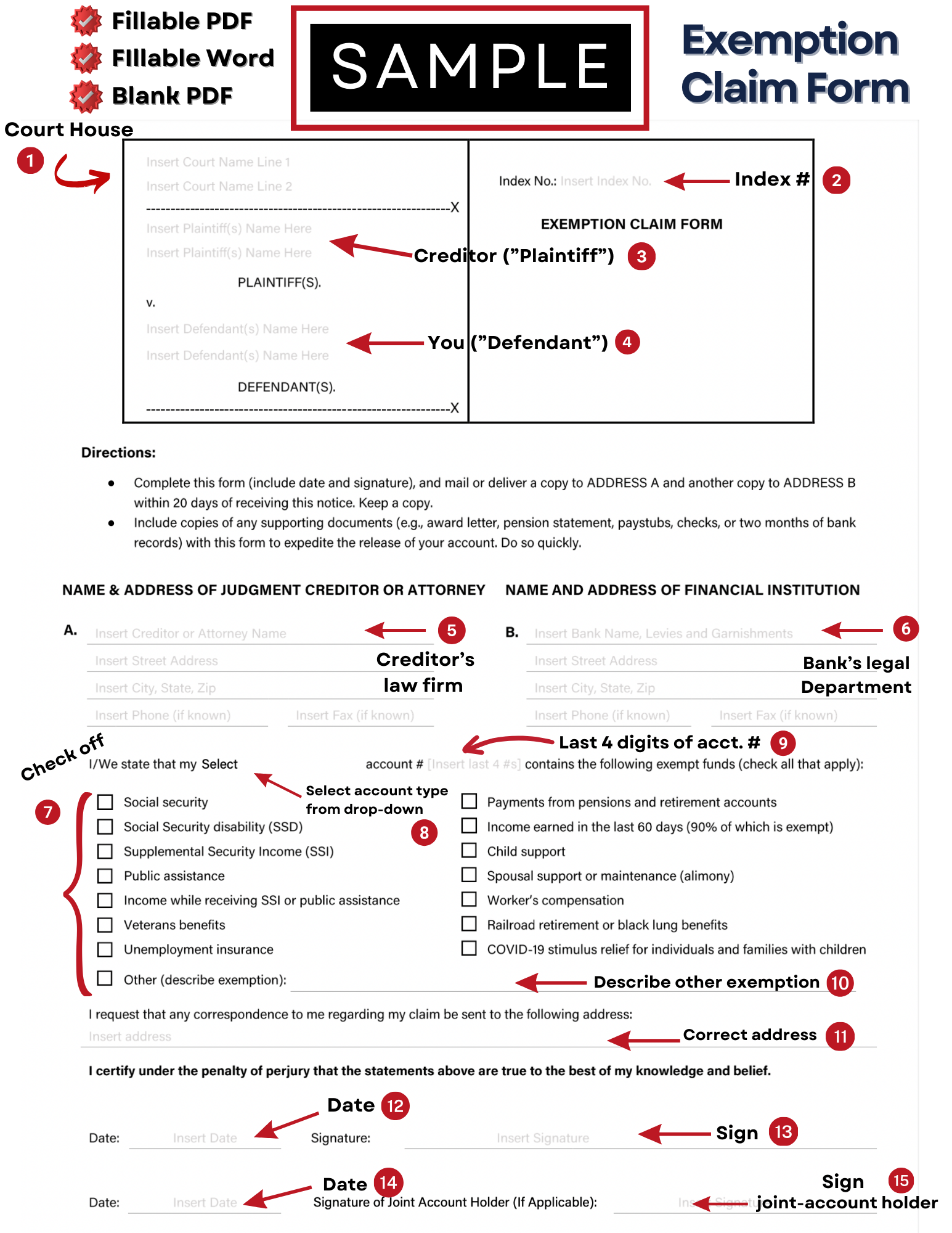

Fillable Exemption Claim Form: A central component of the kit, this form is designed to be filled out easily, whether you’re tech-savvy or prefer to do things by hand. It comes with detailed instructions that correspond to various types of exempt income, such as social security, disability benefits, and pensions, ensuring that users correctly identify and claim the exemptions applicable to them.

Professional Cover Letter: Communication is key when dealing with financial institutions and legal matters. This cover letter is an introductory document to accompany the exemption claim, crafted to clearly articulate the user’s position and rights under the law.

Explanatory Material: Legal processes can be daunting, so the kit includes a simplified flow chart, a timeline of the exemption claim process, and other materials that break down the legal jargon into understandable language. This ensures that users follow the process and understand each step they take.

Easy-to-Use Design: Convenience is at the heart of the kit's design. With fillable PDF and Word forms, users can choose their preferred format. The inclusion of diagrams and numbered instructions further streamlines the process, making the task of filling out forms less intimidating.

Proven Track Record: Developed by an attorney with a deep understanding of consumer protection law, the kit is built on a foundation of legal expertise and a history of defending clients against bank freezes. This expertise is reflected in the accuracy and relevancy of the information provided.

Each document in the kit serves a specific purpose, ensuring that users are well-equipped to tackle each stage of the exemption claim process. The thoughtful assembly of these resources reflects an understanding of the user's perspective—those who are likely already overwhelmed by the legal challenges they face.

Empowerment through Information and Tools

The Exemption Claim Form Kit simplifies legal processes by providing a comprehensive digital package, streamlining users' experience and bolstering their legal confidence. The kit empowers informed self-advocacy and represents a shift towards more accessible legal resources for the everyday person.

Section 4: Why Choose the Exemption Claim Form Kit?

Cost-Effective Legal Empowerment

In an era where legal fees can escalate quickly, the Exemption Claim Form Kit stands out for cost-effectiveness. The traditional route of hiring an attorney to navigate the treacherous waters of bank account freezes can be prohibitively expensive, often surpassing the actual amount at stake. This kit, however, is priced to be accessible, reflecting Jesse Langel’s commitment to consumer advocacy. It’s a fraction of the cost of hiring a lawyer, yet it packs the expertise and experience you’d expect from professional legal services.

For many New Yorkers, this kit levels the playing field, providing the tools and resources to everyone in this financial crisis. Often, the bank accounts frozen are those needed to pay an attorney. By choosing this kit, consumers save on immediate costs and avoid the potential long-term financial strains that come with drawn-out legal battles.

The mere use of the Exemption Claim Form can shift the tides of power to produce better negotiating leverage.

Swift Resolution of Account Freezes

Time is of the essence when dealing with a frozen bank account. The Exemption Claim Form Kit is designed with urgency in mind. It streamlines the exemption claim process, enabling users to meet crucial deadlines — such as the 20 days to file an exemption claim after an account has been restrained under New York law.

The fillable forms and clear instructions reduce the time spent understanding complex legal procedures, ensuring users can act quickly and effectively. This speed is not just about convenience; it’s about reducing the window of vulnerability and restoring access to one's funds as swiftly as possible.

Knowledge is Power

Perhaps the Exemption Claim Form Kit's most significant benefit is its empowerment. Understanding your legal rights and the processes at your disposal is crucial when faced with a financial legal challenge. This kit demystifies the exemption claim process, equipping users with a solid understanding of their rights and how to assert them.

The kit educates users with every form, instruction, and explanatory material, giving them the knowledge to navigate the exemption claim process confidently. This understanding extends beyond resolving the current freeze; it gives consumers the knowledge to protect themselves against potential legal issues.

A Bridge to Self-Advocacy

Choosing the Exemption Claim Form Kit is not just about addressing a frozen bank account; it’s about embracing a proactive stance toward one’s financial and legal affairs. It enables users to take control of their situation, reducing the feeling of helplessness that often accompanies legal challenges.

The kit’s comprehensive nature ensures that consumers are not left with partial information or incomplete guidance. From start to finish, users have a clear roadmap, which can make a significant difference in a situation that often feels chaotic and unpredictable.

Section 6: How the Kit Works

A Step-by-Step Guide to Filing Your Exemption Claim

Using the Exemption Claim Form Kit is designed to be as straightforward as possible. Here’s a step-by-step breakdown of how to utilize the kit effectively:

Download and Review the Kit: Once you purchase the kit from the Etsy shop, you'll download a zip file containing all the necessary documents. Review the "Instructions for Exemption Claim Kit" to get an overview of the process and the documents included.

Identify Your Exempt Funds: Using the information provided, determine which funds are exempt under New York law. This could include social security, pensions, or disability benefits.

Fill Out the Exemption Claim Form: Select the fillable PDF or Word version of the Exemption Claim Form and complete it by following the numbered instructions. The form will ask for specific information about the exempt funds in your account. The fillable PDF Exemption Claim Form and accompanying cover letter use disappearing text ("ghost text") to enable you to write what you need.

Prepare the Cover Letter: Use the fillable cover letter template to create a professional letter accompanying your exemption claim. This letter should state your intent to claim exemptions under CPLR §§ 5222 and 5222-a. The kit's style is a checkbox style with places to add details. The documents were designed to be completed and mailed quickly.

Compile Supporting Documents: Gather any additional documents that support your claim of exemption, such as bank statements or benefit award letters.

Review Your Documents: Check all your filled forms and documents for completeness and accuracy. It's essential that all the information provided is correct to avoid any delays in the process.

Send the Documents: Mail the completed Exemption Claim Form, cover letter, and supporting documents to the bank and any other necessary parties, such as the creditor or the court. Be sure to follow the instructions on how and where to send these documents.

Follow-up: After sending your documents, monitor your bank account and correspondence for updates. If the bank requires additional information, provide it promptly.

Real-Life Impact of the Kit

Imagine the scenario of an elderly retiree whose pension is the sole source of income, suddenly finding their account frozen. With the kit, they can quickly identify their pension as an exempt source of funds, complete the necessary paperwork, and effectively communicate their rights to the bank without hiring an expensive attorney.

Consider a single parent receiving child support, a type of exempt income in New York, who faces a similar freeze. Using the Exemption Claim Form Kit, they can assert their exemption, ensuring they can access the funds needed to care for their child.

Conclusion

The Exemption Claim Form Kit is more than just forms and instructions—it's a lifeline for those caught in the stressful situation of a bank account freeze. By providing a clear and actionable guide, the kit helps New Yorkers navigate the exemption claim process and empowers them to take charge of their financial rights. It's a testament to the power of well-designed legal self-help tools in making a tangible difference in people's lives.

Section 7: Compliance with New York CPLR §§ 5222 and 5222-a

Ensuring Legal Alignment with NY Exemption Laws

Navigating the complexities of New York's exemption laws requires a meticulous approach, one that aligns perfectly with the legal parameters outlined in the statutes. The Exemption Claim Form Kit is crafted to comply with the exacting standards of CPLR §§ 5222 and 5222-a, ensuring that each step in the exemption process adheres to New York law.

CPLR § 5222 details the procedural requirements for a creditor to issue a restraining notice to a financial institution, which in turn freezes the debtor's account. Meanwhile, CPLR § 5222-a provides the debtor with a statutory mechanism to claim exemptions for certain types of funds protected by law from such restraints. These can include but are not limited to, social security benefits, public assistance, pensions, and disability benefits.

The Exemption Claim Form Kit addresses compliance in several ways:

Proper Identification of Exempt Funds: The kit includes a comprehensive list of the funds deemed exempt under New York law, helping users correctly identify which parts of their accounts cannot be legally frozen.

Correct Form Usage: The kit contains the exact forms recognized by New York courts and financial institutions for claiming exemptions. It provides fillable PDF and Word versions, ensuring that users can submit these forms in the accepted format.

Accurate Procedure Followed: Along with the forms, the kit offers detailed instructions that mirror the procedural steps outlined in the statutes, guiding users through the process in a legally compliant manner.

Timely Filing: Recognizing the critical importance of deadlines, the kit instructs users on the specific time frames within which they must act to claim their exemptions, consistent with the deadlines established by New York law.

New York City Marshals Who May Execute Levies Against Your Bank Account(s)

- City Marshal Ronald Moses

- City Marshal Bruce Kemp

- City Marshal Gregg E. Bienstock

- City Marshal Martin Bienstock

- City Marshal Henry Daly

Here is a list of Marshal's Judgments FAQs

Has a Marshal or Sheriff sent a "Levy" On your Bank Account? Don't panic! Here are 4 crucial steps to protect yourself:

- Freeze Warning: A court order has authorized a levy on your account.

- Claim Your Rights: Act fast to object, claim exemptions using our Exemption Claim Form kit, or negotiate with the creditor.

- Shield Your Funds: Exempt deposits might be protected, but proper action is crucial.

- Seek Legal Safeguards: Consult a lawyer to navigate the process and protect your financial well-being.

The Critical Role of Legal Procedures

Compliance with legal procedures is not merely a formality; it is needed to unfreeze funds successfully. Failing to adhere to the proper steps or missing a deadline can result in prolonged account freezes and continued financial hardship. The Exemption Claim Form Kit empowers users to act within the scope of the law, giving them the best chance to swiftly regain access to their funds.

Moreover, the kit's compliance with CPLR §§ 5222 and 5222-a ensures that users’ claims are taken seriously by creditors and banks. When exemption claims are presented correctly and professionally, as the kit allows, financial institutions may be more likely to act quickly to release the funds, minimizing the disruption to the user's financial life.

A Foundation for Successful Claims

By grounding its contents in the specifics of New York's exemption laws, the Exemption Claim Form Kit provides more than a practical solution—it offers peace of mind. Users can have confidence that the steps they are taking are not just effective but legally sound.

Section 8: The Kit vs. Hiring an Attorney

Cost Comparison: Affordability Meets Expertise

One of the most compelling reasons to choose the Exemption Claim Form Kit over hiring an attorney is cost. Legal fees in New York can be prohibitively expensive, especially for consumers dealing with smaller judgments where the cost of hiring an attorney could exceed the amount of money at stake in the frozen account. In contrast, the Exemption Claim Form Kit is offered at a fixed, reasonable price, providing all the necessary tools and guidance without the additional hourly fees that typically accompany legal representation.

For many facing bank account freezes, the kit represents a significant financial reprieve. It is an investment in resolving the current issue and a resource for any potential future legal financial challenges, offering enduring value.

Time Savings: Prompt Action Leads to Quicker Results

When it comes to unfreezing bank accounts, time is a luxury many cannot afford. Each day that passes can mean additional risk of a levy (taking). Hiring an attorney adds another layer to the timeline — finding the right lawyer, scheduling consultations, and waiting for them to act on your behalf. The kit, however, is available for immediate download, allowing users to take prompt action. The step-by-step instructions and fillable forms can be completed and submitted in a fraction of the time it might take to secure an initial legal consultation.

The kit’s design for efficiency means that consumers can act on their schedules, submitting their exemption claim as soon as they have gathered the necessary information. This self-driven process can lead to a quicker resolution, restoring access to frozen funds faster than the traditional legal route might allow.

Effort and Accessibility: Simplifying the Legal Process

Effort is another factor to consider. The legal system can be daunting, and the thought of navigating it without assistance is enough to deter many from taking action. The Exemption Claim Form Kit simplifies this process, breaking down complex legal procedures into understandable steps. It eliminates the need to decipher legal jargon or understand intricate laws — the heavy lifting has already been done by an experienced consumer protection attorney.

The kit's straightforward approach reduces the mental and emotional effort required to address a bank account freeze. With clear instructions and expertly crafted documents, users can confidently manage their exemption claim, which can be especially empowering for those who may feel overwhelmed by the legal system.

Empowerment and Control: Self-Representation Advantages

Finally, there’s the aspect of control. Hiring an attorney means placing your financial fate in someone else's hands. While this can be a relief for some, it can also create a sense of dependency and uncertainty for others. The Exemption Claim Form Kit puts control back in the hands of the consumer. It empowers individuals with the knowledge and tools to handle their legal matters, fostering a sense of self-reliance and confidence.

Conclusion

The Exemption Claim Form Kit stands out as a viable alternative to hiring an attorney, offering cost savings, time efficiency, and self-representation empowerment. For many New Yorkers facing the stress of a frozen bank account, this kit provides a welcome solution that aligns with their financial capabilities and their need for immediate, actionable assistance.

Section 10: Understanding the Challenges in the Exemption Claim Process

The Exemption Claim Form Kit is not just a set of tools; it's a guide through the potential pitfalls of the exemption claim process. Here, we explore common hurdles and advise how the kit helps navigate these challenges effectively.

Challenge 1: Misidentifying Exempt Funds

One of the most common pitfalls is the misidentification of exempt funds. It's crucial to correctly identify which funds in your account are protected under New York law.

How the Kit Helps: The kit includes clear check boxed lists of what constitutes exempt funds, such as social security, pensions, and disability benefits. This clarity helps users accurately identify and claim the appropriate exemptions, reducing the risk of errors.

Challenge 2: Incomplete or Incorrectly Filled Forms

Filing an exemption claim requires attention to detail. Incomplete or incorrectly filled forms can lead to delays or even the denial of the claim.

How the Kit Helps: With fillable forms and step-by-step instructions, the kit ensures that all necessary information is provided correctly. The clear guidance helps avoid common mistakes, making the submission process smoother.

Challenge 3: Meeting Strict Deadlines

Timeliness is key in the exemption claim process. Missing deadlines can result in prolonged account freezes.

How the Kit Helps: The kit outlines the critical timelines and deadlines for filing an exemption claim. Users can ensure they act promptly by providing a structured timeline, avoiding unnecessary delays.

Challenge 4: Navigating Communication with Banks and Creditors

Effective communication with banks and creditors is often intimidating for many people, and miscommunication can complicate the process.

How the Kit Helps: The kit includes a professional cover letter template with checkboxes that users can customize to communicate their claims effectively. This helps in presenting the case clearly and assertively to the relevant parties.

Tips for a Smooth Exemption Claim Process

Read All Instructions Carefully: Before starting, read through all the materials provided in the kit to understand the process comprehensively.

Gather All Necessary Documents: Ensure you have all relevant documents, such as proof of exempt income, before filling out the forms.

Double-check all Entries: Review your completed forms for accuracy. A small error can lead to delays.

Keep Copies of Everything: Keep copies of what you send to the bank and creditors for your records.

Follow-Up: After submitting your claim, don’t hesitate to follow up with the bank or creditors if you don’t receive a timely response.

Conclusion: Unlocking Your Financial Freedom

As we close our comprehensive exploration of the Exemption Claim Form Kit, we should reflect on the key insights we've gathered. This journey has taken us through the intricate labyrinth of New York's exemption laws, the financial and emotional toll of frozen bank accounts, and the empowering solution offered by the Exemption Claim Form Kit.

Key Points Recap:

Understanding Bank Freezes: We delved into the mechanics of bank account freezes under New York law, particularly under CPLR §§ 5222 and 5222-a, setting the stage for the importance of having the right tools to navigate these situations.

The Financial and Emotional Impact: We highlighted the often-overlooked emotional and financial hardships caused by frozen accounts, emphasizing the urgent need for accessible and effective solutions.

Introducing the Kit: We presented the Exemption Claim Form Kit as an innovative, attorney-crafted solution, offering a detailed breakdown of its contents and how each element is designed to assist in the exemption claim process.

Benefits of the Kit: Its cost-effectiveness, efficiency in resolving freezes, and empowerment through legal understanding were underscored as its standout benefits.

Kit Versus Attorney: We compared using the kit to hiring an attorney, highlighting the kit's advantages in terms of cost, time, and personal empowerment.

Success Stories: Real-life narratives from New Yorkers who successfully unfroze their accounts using the kit brought to life its practical impact and effectiveness.

Navigating Challenges: We provided guidance on avoiding common pitfalls in the exemption claim process and tips for a smooth experience.

A Call to Action: Invest in Your Financial Liberation

The Exemption Claim Form Kit is more than just a set of documents; it's a pathway to reclaiming your financial autonomy. In a world where legal challenges can appear daunting and insurmountable, this kit stands as a beacon of hope and empowerment. It's an investment not just in resolving a current financial hurdle but in equipping yourself with the knowledge and tools for any future challenges.

If you or someone you know is grappling with a frozen bank account in New York, the Exemption Claim Form Kit offers a clear, effective, and affordable solution. Don't let legal complexities and creditor actions keep your funds out of reach. Take the first step towards financial liberation and add the Exemption Claim Form Kit to your cart today. Secure your financial freedom and peace of mind.

Appendix: Further Resources for Empowerment and Understanding

In addition to the comprehensive assistance provided by the Exemption Claim Form Kit, expanding your knowledge on New York exemption laws and financial literacy is crucial for long-term financial empowerment. Below are additional resources that can help deepen your understanding and provide further guidance in navigating financial legal challenges.

Understanding New York Exemption Laws:

- New York State Unified Court System Website: Offers detailed information on CPLR §§ 5222 and 5222-a, including updates on any legal changes.

- New York Legal Aid Group (NYLAG): Provides free legal services and educational resources on consumer rights and exemption laws in New York.

- Legal Services NYC: Offers guidance and educational material on various aspects of New York’s exemption laws and how they apply to consumers.

General Financial Literacy and Legal Education:

- Consumer Financial Protection Bureau (CFPB): A federal agency that offers extensive resources on financial literacy, including understanding your rights as a consumer.

- National Consumer Law Center (NCLC): Provides consumer-focused publications and articles on financial issues, including dealing with debt collectors and understanding your legal rights.

- LawHelpNY: Offers resources and information to help New Yorkers resolve legal issues and improve their financial literacy.

Tools and Guides for Self-Representation:

- Nolo: Provides a wide range of legal guides and DIY resources for those who choose self-representation in legal matters.

- American Bar Association's Public Resources: Offers various guides on understanding the law and representing oneself in legal matters.

Local Community Resources:

- Your Local Public Library: Often hosts free workshops and seminars on financial literacy and legal rights.

- Community Legal Clinics: Many communities offer free legal clinics where you can get advice and resources on handling legal financial matters.

Online Forums and Support Groups:

- Legal Advice Subreddits on Reddit: Online forums where you can ask questions and share experiences related to legal financial matters.

- Consumer Advocacy Groups on Social Media: Platforms where you can connect with others facing similar challenges, share advice, and gain moral support.

Remember: While these resources are valuable, they should complement, not replace, professional legal advice when needed. Always consider consulting with an attorney for specific legal issues or complex situations.

Disclaimer: The Exemption Claim Form Kit is not a substitute for legal advice.

Here is a link to the product and the Legal Demand Documents.

Case 1: Court Requires Hearing Rather Than Summary Judgment Process For Exempt Income Protection Act Claims

A judgment creditor who had frozen a debtor's bank account moved to declare the funds non-exempt from enforcement. Despite the creditor's attempt to treat the matter like a summary judgment motion and place the burden of proof on the pro se debtor, the court ordered a hearing, emphasizing that the Exempt Income Protection Act (EIPA) was specifically designed to protect unrepresented debtors from losing exempt income through bank account seizures.

Key Legal Principles:

- Under CPLR § 5222-a, a debtor's Exemption Claim Form alone serves as prima facie evidence that funds are exempt, shifting the burden of proof to the creditor.

- Judgment debtors are not required to provide supporting documentation with their Exemption Claim Form, though they are encouraged to do so to expedite the unfreezing process.

- EIPA matters require hearings rather than paper-based motion practice to protect pro se debtors from disadvantages in defending their exempt assets.

Conclusion: EIPA proceedings require special procedural protections for judgment debtors, including in-person hearings rather than summary judgment-style paper submissions, reflecting the statute's purpose of protecting unrepresented debtors' exempt income from seizure.

Citation: Midland Funding LLC v Roberts, 37 Misc 3d 617 (Sup Ct, Sullivan County 2012).

Case 2: New York's Separate Entity Rule Bars Restraining Foreign Bank Branch Assets Through Service on NY Branch

A judgment creditor sought to freeze assets held in foreign branches of an international bank by serving a restraining notice on the bank's New York branch. The judgment creditor had obtained judgments totaling over $3 billion. The Court of Appeals held that under New York's separate entity rule, serving a restraining notice on a bank's New York branch is ineffective to freeze assets held in the bank's foreign branches.

Key Legal Principles:

- The separate entity rule treats bank branches as separate entities for purposes of restraining notices and postjudgment enforcement proceedings.

- A restraining notice served on a New York branch is effective only for assets held at that branch, not at foreign branches.

- The rule promotes international comity, protects banks from competing claims/double liability, and recognizes practical constraints of cross-border banking.

Conclusion: The separate entity rule remains valid in New York as a limiting principle in international banking despite technological advances, primarily to avoid conflicts between competing legal systems and protect banks operating across multiple jurisdictions.

Citation: Motorola Credit Corp. v Standard Chartered Bank, 24 NY3d 149 (2014).